At Bankrate, we strive to help you make smarter financial decisions. To help readers understand how insurance impacts their finances, we commissioned insurance professionals who have spent a combined 47 years working in the auto and home insurance industry. and life insurance. While we adhere to strict editorial integrity, this article may contain references to products from our partners. Here's an explanation of how we make money. Our content is supported by Coverage.com, LLC, a licensee (NPN: 19966249). For more information, please see our Insurance Disclosure.

The Best cheap car insurance in Tulsa for 2023

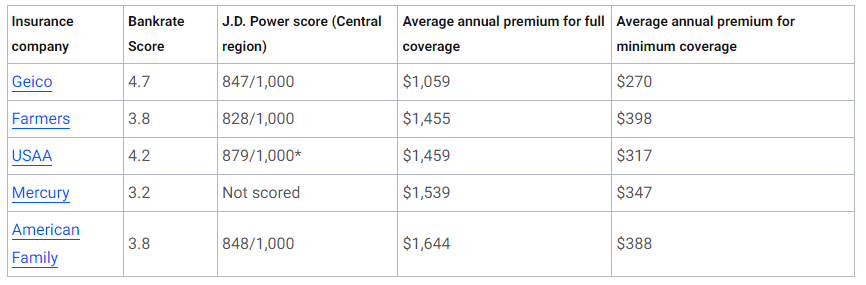

According to Bankrate's 2023 analysis of annual premiums cited, the cheapest auto insurance companies in Tulsa, Oklahoma include Geico, Farmers, and USAA. Bankrate understands that finding the best auto insurance possible isn't just about price. So we chose carriers with high customer satisfaction scores, financial strength ratings, coverage options, discounts, and digital tools.

Compare auto insurance prices

Answer a few questions to find out personalized rates from the best service providers.

Do you insure multiple vehicles? Correct

Yes Or No

Are you participating in insurance? Correct

Yes Or No

Are you the owner?

Yes Or No

Best cheap auto insurance companies in Tulsa

The average annual cost of auto insurance in Tulsa is $2,158 for full coverage, or about $180 per month, while the average minimum coverage is $479 per year, or about $40 per month. These prices are higher than the national average insurance costs of $2,014 per year for full coverage and $622 per year for minimum coverage. Higher comprehensive auto insurance rates in Tulsa may be due to factors such as the higher population density in the Tulsa area, which can increase the risk of accidents.

Based on premium data from Quadrant Information Services, we found that the cheapest auto insurance companies in Tulsa include Geico, Farmers, USAA, Mercury, and American Family. In addition to looking for companies that offer cheap interest rates on average, Bankrate also looks at several other factors to determine how companies stack up. Third-party coverage options, discounts, and ratings, such as J.D. Auto Insurance Research.

Power 2022 and AM's Best Financial Strength Rating, are both included in our rankings. These and many other factors contribute to each carrier's five-point discount rate score. We hope these discount rate scores give you a general overview of how a company can meet your insurance needs.

Geico

Geico offers some of the cheapest average auto insurance rates in Tulsa, for both full and minimum coverage options, according to our analysis of premium data. Not only does Geico offer competitive pricing for the area, but drivers can also appreciate the large number of discounts available. Potential discounts include safety features, student vouchers, multi-vehicle savings, and links. Geico also scored above the segment average for customer satisfaction in the Central region, indicating policyholders were generally satisfied with service levels.

Farmers

Farmers offer a variety of additional coverage options for drivers who appreciate a customizable policy. In addition to standard coverage, you can take out a more robust policy that includes windshield coverage, accident compensation, and new vehicle replacement. In addition to Tulsa's low average rates, policyholders can save on their Farmers' premiums through potential discounts on family-shared vehicles, long-distance students, and on-time payments. Farmers scored slightly lower than the segment average for J.D. customer satisfaction. Power. You may therefore want to discuss service levels with current policyholders.

America

USAA consistently receives high marks from J.D. Power on customer satisfaction, but this carrier is open only to current and former military members and their immediate families. Military members may appreciate the carrier's military-specific discount options, including potential savings on on-base parking. USAA only does business online and over the phone, so if you want to deal directly with an agent, this may not be the service provider for you.

Mercury

Mercury Insurance may be a good option for customers who prefer to work with a regional carrier. Mercury is only available in 11 states, which may be why it wasn't included in J.D.'s customer satisfaction study. Power. Mercury doesn't offer as many approval and discount options as some major carriers, but it does offer car rental reimbursement and rideshare insurance. Discounts may be available on safety equipment, low mileage, and packages.